The corona virus has impacted almost all sectors including the crypto market. However, the effects observed are a bit different from the other sectors. Although the financial sector has been equally impacted, the crypto market has seen a rise in these turbulent times, which was a bit astonishing for investors, traders, and crypto enthusiasts.

While most of the experts predicted the crypto market to fall below recovery levels, surprisingly, it hasn’t decreased even by a minute level. This is just a generalized explanation of how coronavirus has impacted the crypto market. Read on to know how it has changed the trends, impacted the traders’ attitudes, and affected the long-term outlook of the crypto market.

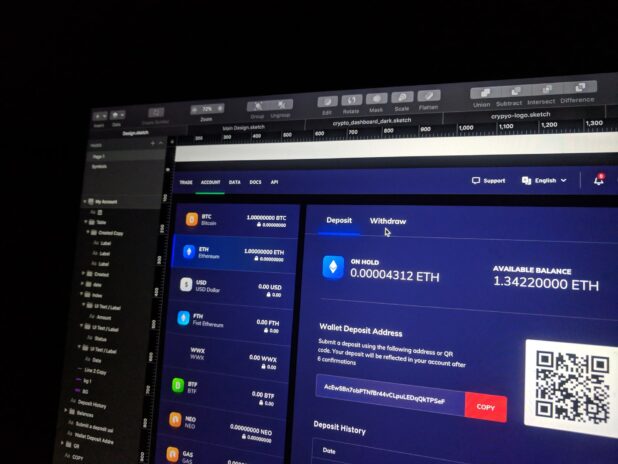

Numerous crypto platforms are mushrooming day in and day out. But, there are only a few reliable sources. Right from providing technological assistance to providing comprehensive safety and security for your crypto account and wallet, QuantamAI is the one-time solution for modern crypto needs. Click here to explore the wide range of features and services this crypto platform offers and unleash your hidden potential of investments and trading.

Table of Contents

1. Digitized economy

Although the world has been increasingly aiming for a digital economy for quite a time now, the pandemic seemingly pushed for the change pretty passionately. With the pandemic induced lockdown, all the economic transactions moved online. Enthusiastic investors and traders, who are waiting for a perfect time to start their crypto adventures, started doing so with a lot of free time in hand.

Few others even went ahead and utilized the free time to learn and embark on the new journey. With the increasing population looking towards building digital assets and searching for paper cash alternatives, the crypto market has seen a drastic increase in its price and activity as well.

2. Price

As all the financial markets saw a decrease in activity and faced severe cash crunch, the crypto market went against the trends and developed like never before. Even experts predicted the crypto market to doom amidst the pandemic. But, to everyone’s surprise, it has only seen increased growth. There are a lot of reasons for this shocking trend.

While the need for digital cash or assets was largely felt and the gap remained as it is because of absence of similar assets. It acted as an alternative to physical assets. As mobility was largely restricted, crypto trading served as the best alternative for investments, trading, and even transactions in this pandemic.

3. Different for some

Yes, the entire crypto market has soared. But, certain geographical regions have seen a decreased activity in the crypto market. This is because of the sudden need for large amounts of liquid cash. The corona pandemic has called for unprecedented amounts of mobilization of cash. Following this, investors and traders liquidized most of their assets including bitcoins and cryptocurrency too. This trend is still visible in the USA.

However, experts predict that this is just a temporary downturn and it will subside sooner or later once the coronavirus is chased out. A few of them also predict that bitcoins will soar once again in the near future.

4. Adoption

Corona or not, governments across the world have been moving the pawns to recognize, acknowledge, and adopt cryptocurrency on a large scale. While some countries like India banned these currencies outright, regions like the UK adopted them but with appropriate and all relevant security and safety measures in place. Similarly, other countries also started adopting and recognizing digital assets, which encouraged investors to invest and trade.

5. Investor sentiment

Coronavirus has left the financial sector on a roller coaster ride. As the sudden halt in production and manufacturing has kicked in a cash crunch in the economy, the future of the stock market has become uncertain, hurting investor sentiment. Also, due to speculative spending and other similar reasons, the regular economy was severely impacted by the inflationary trends the world over.

Thus, investors and traders searched for alternatives that are averse to such harmful inflationary trends. Gold and cryptocurrency are two such assets. Hence, this sentiment of investors has been reflected in the crypto market growth.

6. Absence of regulation and scrutiny

Lack of regulation and public scrutiny has always been one reason for the growth of the crypto market. Of course, these factors make it a safe haven for illegal traders, investors, and other illicit activities. The main reason is that cryptocurrencies function on the decentralized ledger and cannot be decrypted. This makes the activities for them easier. Not that all the transactions are easier, but these and other related activities can escape scrutiny. Even for people who want to evade tax, crypto can be a good alternative investment.

Cryptocurrencies have been here for a long time now. But, coronavirus has impacted this industry beyond the threshold level. After all, despite being in presence, it is still in its nascent stage in terms of gaining recognition. The last decade itself has been a deciding one for cryptocurrencies and the market. Had it not been for globalization, rapid digitalization, and economic growth, it would have taken another five decades to see the same growth we are experiencing now.

Financial news is covered by almost all major news outlets. But, crypto news is not as often seen as financial news. If you are an investor or trader and want to receive every update, https://prawica.net/trading-software/crypto-genius-recenzja-2021-czy-to-jest-legalne-czy-falszywe/ this is the best place to find the required updates. It not only updates but rather educates about the trends, technicalities involved, and other doubts or similar topics that involve cryptocurrencies.

Compared to other sectors, the pandemic has impacted the crypto market on a minimal scale but the minimal impact itself has affected the investors and traders on a large scale. But, this doesn’t mean the crypto story ends here. This is just the peace before the roaring sound that the crypto is going to make before it climbs the top charts, according to experts and investors.

World Magazine 2024

World Magazine 2024